What is VBS?

VBS was first implemented in January 2023 as part of the Haven 3.0 tokenomics update.

As of 29th August 2023, it was updated along with the rebase to Monero v0.18, under Haven 3.2.

VBS stands for Vault Backed Shoring. The phrase implies that you need to back your shoring (offshores & onshores) with funds in your vault.

It is a value, a multiplier, which determines the amount of Collateral required in a vault in order to be able to offshore (XHV -> xUSD) or onshore (xUSD -> XHV).

Collateral is referred to as the amount of unlocked XHV in the vault.

What is the purpose of VBS?

In combination with a 14 day lock time of the Collateral and a 24 hour lock time for the Converted Amount, VBS was designed to:

- Prevent price manipulation of XHV on exchanges in order to increase XHV inside the vault and to profit from at the expense of XHV holders.

- Prevent excessive and rapid inflation of XHV by slowing the shoring process.

- Prevent a death spiral.

In the latest release, Haven 3.2, the VBS requirements have been reduced significantly in order to: - speed up conversions and get the protocol working again.

- help xUSD regain its peg.

How is VBS calculated?

VBS is a function of the Market Cap Ratio.

Market Cap Ratio

The market cap ratio is a measure of the protocol’s state of health.

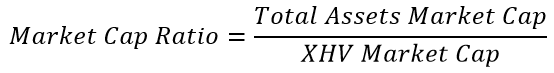

The formula for calculating the market cap ratio is:

Total Assets Market Cap is the combined value (in Dollars) of all the xAssets (xUSD, xBTC, xAU, etc.).

XHV Market Cap is the current circulating supply of XHV multiplied by the current price of XHV.

The ratio between these two market caps determines the state of the protocol.

When the market cap of XHV is larger than the Total Assets market cap, the ratio is small, and the protocol is considered to be in healthy state.

When the ratio is high, the protocol is considered to be in a bad state.

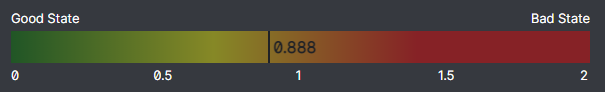

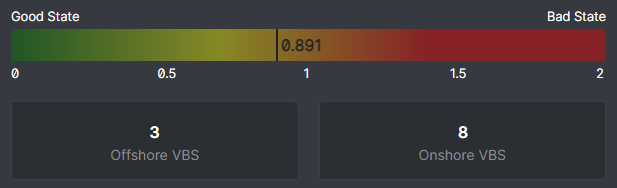

If you log into Haven’s Web or Desktop vault, you will see this ratio displayed on a coloured chart, as shown below.

A healthy state is considered to have a ratio of 0.1 or less, where the XHV market cap is at least 10 times the size of the Total Assets market cap. This affirms that all xAssets are safely backed by the underlying asset of our protocol, XHV.

Market Cap Ratio Calculation

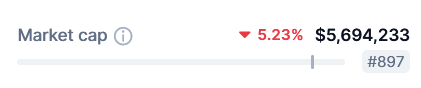

To calculate the market cap ratio for yourself, you need to first calculate the market caps of XHV and the Total xAssets.

The quickest way to get the market cap for XHV is to head over to

https://coinmarketcap.com/currencies/haven-protocol/

The Total Assets market cap is slightly trickier to calculate, unless you are able to automate it.

First, you need to get the circulating supply of all assets, apart from XHV:

https://explorer.havenprotocol.org/supply

Next, you need get the current price for each of those assets from the oracle:

https://oracle.havenprotocol.org/

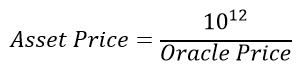

Since Haven’s assets have a large degree of atomic units (12), the oracle price is shown to the power of 12. To calculate the asset price, use the following formula:

Once you worked out the market cap of each asset and added them together, you will arrive at the Total Assets market cap. Now you can calculate the market cap ratio using the formula shown above in the Market Cap Ratio section.

VBS Calculation

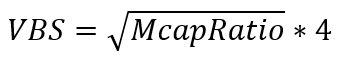

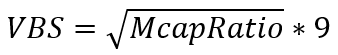

The calculation of the VBS has been simplified since the release of Haven 3.2, which can be expressed in a single formula.

Offshores and Onshores have a different formula for calculating the VBS in order to make XHV slightly more deflationary compared to xUSD.

Offshore VBS (XHV -> xUSD)

Onshore VBS (xUSD -> XHV)

When you log into Haven’s Web or Desktop vault, the Onshore and Offshore VBS values are displayed just underneath the Market Cap ratio chart:

VBS and the Market Cap Ratio

There are three main factors that can contribute to a rise in VBS:

- A decrease in the price of XHV.

- Too much offshoring, lowering the market cap of XHV (if price doesn’t rise).

- Too much onshoring, which can lead to an increase in the sell pressure of XHV and hence a drop in its price.

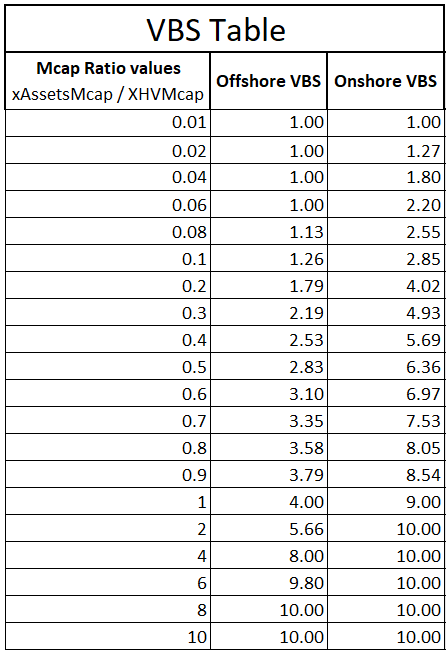

The table below shows the values for the Offshore & Onshore VBS across a range of market cap ratios.

A few points to note about the table:

- The minimum VBS is 1.

- The maximum VBS is 10.

- VBS is more protective towards Onshores in order to prevent inflating XHV too much, too quickly.

How is VBS applied?

VBS is used in conversions between XHV and xUSD (Offshores and Onshores), and its value determines the amount of collateral required for the shoring process.

Offshore example

If you want to offshore 100 XHV and the current VBS has been calculated to be 3, you will require 100 x 3 = 300 XHV as collateral.

After conversion has been confirmed, the 100 XHV that has been converted to xUSD will be unlocked after 24 hours and the collateral (300 XHV) will be unlocked after 14 days.

Onshore example

If you want to onshore 100 xUSD and the current VBS has been calculated to be 10, and the price of XHV is $0.20, you will require (100 / 0.20) x 10 = 5,000 XHV as collateral.

After conversion has been confirmed, both, the converted amount (100 xUSD, or 500 XHV) will be unlocked after 24 hours and the collateral (5,000 XHV) will be unlocked after 14 days.

Will VBS be applied to xAssets?

We are not currently planning to add VBS to xUSD <-> xAssets conversions.

This subject has been discussed extensively in our discord server, so if you would like to voice your opinion on this, please join our server and comment in the “havenomics” channel.

Useful links

Below is a list of some useful links in relation to conversions and VBS.

Haven’s circulating supply for all assets

https://explorer.havenprotocol.org/supply

Oracle prices for all assets

https://oracle.havenprotocol.org/

Transactions

https://havenprotocol.org/knowledge/haven-transactions/

Converting assets

https://havenprotocol.org/knowledge/converting-assets/

Haven Chain Analysis

This site is currently under construction and when it is ready, it will display charts, market caps, conversion statistics, VBS analysis and more.

https://havex.io/haven

Haven 3.0 Proposal

https://havenprotocol.org/2022/10/02/haven-3-0-tokenomics-proposal/